Continuing with the strategy set for Uruguay Round 2009, the Uruguay Round II was planned and started to be executed right after the signature of contracts arising from Uruguay Round 2009. The objectives of this second bidding round were to keep and reinforce the position of Uruguay in oil companies as an opportunity to develop oil exploration business, and to consolidate such interest throughout the submission of bids to explore Uruguay’s offshore.

The preparative activities of the project included the revision of the bidding round terms and contract models, the promotion through scientific material and papers, the participation in international conferences and congress, meetings with executives and managers of the main interested oil and gas companies, the production of diverse promotion elements, including the new design and re-launch of the web page www.rondauruguay.gub.uy, with a more dynamic and interactive concept. The promotion activities included some presentations and data-rooms held in Houston and Río de Janeiro, to bring the technical and exploratory database to the oil companies that were strongly working as operators in Brazil’s offshore and in the Gulf of Mexico, almost one year in advance to the official announcement of Uruguay Round II.

Through this promotion strategy, the brand "Uruguay Round" of exploration and production of hydrocarbons was consolidated, being a value for ANCAP and the country, which is intended to be maintained.

Regarding the technical knowledge to support the bidding round, some advances in the technical and economic evaluation of identified prospects were made, which allowed the definition of new more adequate blocks, minimum exploratory requirements tailored for the prospectivity of each block, in addition to designing more specific prospects focused in exploratory works (like 3D seismic and Controlled Source Electro Magnetism). The seismic stratigraphic interpretation of offshore basins and special geophysical studies, constituted the most important promotion products of exploration opportunities in offshore Uruguayan basins, frontier basins of high exploratory risk.

The bidding round terms and the contract model were considerably improved with regards to those of Uruguay Round 2009, simplifying the evaluation of offers and at the same time modernizing the criteria for the computation of profit oil sharing, cost oil, etc, which was very well received and highlighted by oil companies. The blocks were awarded to the offers with better committed exploratory program, higher profit oil for the Uruguayan state, and higher percentage of ANCAP’s association offered.

At the same time, ANCAP searched for other mechanisms to generate data of the offshore basins, because it was understood that one of the major uncertainties of these frontier basins is the lack of exploratory data.

On one side, multiclient contracts with the main international service companies were promoted for data acquisition and scientific studies. These agreements are non-exclusive, all the risk and cost of the survey is assumed by the service company and ANCAP is the owner of the data. In return, the service company has the exclusive right to market the data for a given period of time. ANCAP has been using this kind of agreement with many of the most important service companies in the oil industry (CGG, ION/GXT, FUGRO, PGS, GEOEX, FIT, TGS, WesternGeco, EMGS, ROBERTSON), which has contributed with important revenues for ANCAP, the generation of new exploratory data and constant promotion of exploration opportunities in Uruguay.

On the other hand, an offshore geophysical data acquisition program was designed, and the technical and legal terms for the open call, which was held on December 2010, were prepared. Between March andJune 2011, 6300 Km of 2D Seismic data acquisition, gravimetry and marine magnetometry took place, by Reflect Geophysical, with exclusive rights for ANCAP. The aim of this work was to determine the hydrocarbon potential and provide information to promote hydrocarbon exploration in offshore basins. ANCAP’s E&P staff was in charge of all operations of the offshore survey, including design and control of the survey and quality control of the posterior processing. The new data was used by ANCAP to support the geological assessment of the areas, and as an input by oil companies interested in participating in Uruguay Round II. Additionally, there was an open call for this seismic data processing, which was awarded to WesternGeco.

With this new available data, the Uruguay Round II was officially announced, calling for bids for 15 offshore areas for oil and gas companies interested in carrying out exploration of hydrocarbons with production sharing contracts. Uruguay Round II objectives were still quite modest, and the pillars in which it was based were very similar to those of Uruguay Round 2009: keep and reinforce the position of Uruguay in oil companies as an opportunity to develop oil exploration business, and to consolidate such interest throughout the submission of bids to explore Uruguay’s offshore.

However, there was a huge difference: the remarkable interest shown by the petroleum industry, particularly by the majors, to access information about the bidding round terms, main characteristics of the contracts, and to follow the advances of exploration activity.

The official announcement was held in September 2011 in Montevideo, and afterwards road shows and data rooms were held in October and November in Houston, London and Río de Janeiro. About 400 people attended these events, from 40 oil and gas companies (25 of them Top 100) and from a similar amount of service companies.

The sale of data directly by ANCAP, together with the revenue sharing from multiclient data, represented significant profits for ANCAP (approximately 15 MMUS$), which clearly reflects the interest shown by the industry in evaluating the offshore Uruguayan basins with regards to participating in Uruguay Round II.

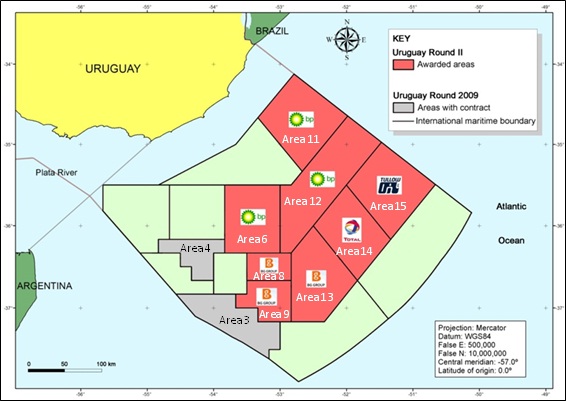

At the closing of Uruguay Round II, on the 29th of March 2012, ANCAP received 19 offers for eight of the 15 offshore blocks offered, from nine oil companies. There was competition for five of the eight awarded areas, among three or more companies. The awarded areas are located in the three offshore basins. From the 11 companies that qualified and were able to submit offers, nine did it (BG, BP, CEPSA, ExxonMobil, Murphy Oil, Shell, Total, Tullow Oil and YPF) individually or through a consortium. More than 50% of the offered area would have exploratory work, by the new four companies that would operate in Uruguay: British BP and BG, French Total and Irish Tullow Oil. Uruguay could boast of an impressive array of companies operating in its embryonic upstream space, with the winning companies joining existing companies at that time: Petrobras, YPF and Galp Energia.

Map showing the 15 Areas offered in Uruguay Round II. Areas 6, 11 and 12 were awarded to BP, areas 8, 9 and 13 were awarded to BG, area 14 was awarded to Total and area 15 was awarded to Tullow Oil.

A transparent and efficient method for evaluating the offers was designed by ANCAP’s E&P staff, which allowed in a few hours after the submission of offers the announcement of the companies that were awarded each area, without questioning. Likewise, the signature of contracts was effectively carried out approximately 6 months after the submission of offers, which also represents a short time compared to industry standards.

The new companies, whose representatives expressed satisfaction with the adjudication process, developed exploratory operations in Uruguay’s offshore, committing a total of USD 1,562MM for the first exploration period ofthree years. The total exploratory committed program included: one deep waters exploratory well, 3,000Km of 2D seismic, 33,240Km2 of 3D seismic, 13,080Km2 of 3D electromagnetism and 130 seabed samples, additional geological studies and Special Seismic Processing Studies (AVO, PSDM, etc),which represents a very significant increase in the geologic knowledge of Uruguayan offshore basins. As mentioned previously, the exploratory works have advanced considerably by operators with regards to the committed programs. Even more, the operators are carrying out more exploratory work than the contract requirements.

Another important aspect is that farm-out/farm-in processes have taken place in the awarded blocks, joining new excellent contractors:

- INPEX, which acquired the 30% share, and Statoil, which acquired 35% of block 15, of which Tullow Oil kept the operation.

- ExxonMobil, which acquired the 35% share and Statoil 15% of block 14, of which Total kept the operation.

- There was also a farm in in block 13 operated by BG (currently Shell), of Total by 25%, ExxonMobil by 17.5% and Statoil by 7.5%.

In accordance to the signed contracts, the awarded companies of each block assume all risks and costs from operations through all exploration and production stages. These are typical Production Sharing Agreements, by which firms benefit from hydrocarbon production available according to the percentages offered.The contract period is 30 years, which could be extended 10 more years by the Executive Branch.

The exploratory period comprises a basic 3-year subperiod, in which the committed exploratory program must be performed. There is a voluntary additional 3-year subperiod where contractors must drill at least one exploratory well and a 2-year extension period, where the contractor mustdrill another exploration well, and return 30% of the block area to the Uruguayan State.

ANCAP will have the option to purchase all or part of the hydrocarbon production companies if needed for domestic consumption. ANCAP also may partner with companies for the production in areas, with a minimum of 20% and a maximum set by the winning bid for each block.

These contracts which resulted from Uruguay Round II are very good for the Uruguayan State, due to the great amount of committed exploratory work, to the Profit Oil sharing among the parties and to the high ANCAP association percentages agreed. Considering the average agreed contract terms, Contractor’s take is 35% and Uruguayan (Government + ANCAP) take is 65%. This kind of value of Government’s take is very good for Uruguayan interests and it is comparable to the takes obtained by countries with oil and gas production. Such values are hardly achieved by countries with oil production or discoveries, and rarely achieved by countries with frontier basins.