Pragmatism reaps licensing round success: that was the view of important international consultants about the results of Uruguay Round 2009. The round was considered to be a success due the tough financial and commodity pricing environment ruling by the end of 2008 and 2009, and the high risk nature of the acreage offered. This result vindicates ANCAP’s earlier decision to revise the original bidding round terms in response to that difficult business environment. The key change was the removal of a compulsory drilling requirement during the first exploration phase in the most prospective blocks. Important industry players also perceive that if the mandatory drilling had remained in place, there was a very real risk that no offers would have been received. They finally stated that it is to ANCAP’s credit that it changed the rules as the situation demanded, adding further weight to the view that Uruguay is a good place to do business.

After 30 years of very limited exploration activity in Uruguay, the Government through ANCAP and the Norwegian geophysics company Wavefield-Inseis ASA (nowadays completely acquired by CGGVeritas) joined efforts with a very challenging aim: reach a comprehensive knowledge of all offshore Uruguayan basins. For such purposes a regional survey of 7000Km of 2D seismic was carried out. It was afterwards supplemented by an 2D seismic infill carried out in 2008 in Punta del Este basin. This new 2D seismic information, with an excellent quality, achieve its purpose of removing the geological and geophysical veil of uncertainty that lied over one of the most promising and with more hydrocarbon potential sedimentary provinces of the occidental margin of the South Atlantic.

Akademik Shatski – Wavefield Inseis vessel that carried out the 2008 2D seismic survey.

Based on these promising results the Uruguayan Government decided to launch Uruguay Round 2009, which was a call for bids for awarding Exploration and Exploitation of Hydrocarbons Contracts in areas on the Uruguayan continental shelf.

The four objectives of the Uruguay Round 2009 project were:

To put Uruguay in the world oil & gas map

To make international oil companies consider Uruguay as a destination in their upstream budgets for exploration in frontier basins

To achieve the qualification of more than one Top 100 oil company of the annual ranking of Energy Intelligence Research.

To obtain at least one offer the 1st of July of 2009, when bids were due to be placed.

The efforts to achieve these objectives were based on 3 main pillars: to establish an appropriate legal and regulatory framework, a strong technical support able to show the exploratory potential of our basins and finally, the optimal investment and business environment of our country. The promotion of these pillars towards the upstream oil and gas industry consisted in a key aspect for the success of the project.

Regarding the bidding round terms and regulatory framework, the type of agreement is a PSC (Production Sharing Contract) in which the Contractors bear all the risks and costs of the activity. No royalties, signature bonus, production bonus or surface rentals are applied. The only Government take is its share of the Profit oil. The offers, which could only be placed by qualified oil companies, were compared based on the exploratory program and the economic terms offered. Oil companies’ qualification was based on their technical, economic and legal background.

ANCAP’s offshore database consists of 2D seismic information from the 70’s and 80’s (about 12.000Km), the well cuttings, logs and reports from the only 2 wells drilled offshore by Chevron in 1976, and 2D seismic multiclient data acquired recently (about 12.000Km).

Map of location of 2D seismic surveys and wells.

In relation to technical issues, an important effort was made in order to highlight the exploratory potential of Uruguayan offshore basins. A comprehensive interpretation of the new seismic surveys was made, defining new leads or confirming the previously defined leads and establishing geological models and analogies with producing basins of the Atlantic margin. Some products were produced by special processing of the acquired seismic data, like seismic inversion, identification of velocity anomalies, detection of gas chimneys, direct identification of hydrocarbons by frequency anomalies, oil seeps detection by satellite images and identification of AVO anomalies.

The promotion of the project involved the assistance to world class upstream or oil and gas meetings and conferences, to spread information material and meet with technical staff and managers of international oil companies. The web page www.rondauruguay.gub.uy was used as a key means of presentation of information. Likewise, many meetings or workshops were conducted “one on one” between ANCAP and more than 50 oil companies. Also a road show was organized in Houston, TX, with the presence of 14 oil companies, 13 of which are Top 100. A database with contacts in more than 500 international oil and gas companies was made, and all the info related to the project was spread to all the contacts. Finally, many scientific papers and disclosure articles were published in industry related journals and magazines, which represented a key tool for the technical promotion of the exploratory potential of the offshore Uruguayan basins.

The fact that ANCAP and the Uruguayan Government, throughout its own contacts in petroleum companies database, was able to gather the presence of many important unpstream companies in the Road Show in Houston and in the launching of the Uruguay Round 2009 in Montevideo, involves that the promotion over the last years and more intensive during 2008, has put Uruguay in the world oil & gas map. Also, the fact that you dear reader are spending some time with this lines is another proof of that. The “brand” Uruguay Round is known in the upstream of the oil and gas industry and constitutes one intangible asset of ANCAP.

Six companies submitted their documents and were qualified to submit offers: BHP Billiton from Australia, GALP from Portugal, PDVSA from Venezuela, Petrobras from Brasil, Pluspetrol from Argentina and YPF also from Argentina. Three out of these 6 companies are Top 100: BHP Billiton, PDVSA and Petrobras. All of them qualified as operators except for GALP, which qualified as a non operator. YPF, Petrobras and GALP joined to form a consortium, which submitted offers for blocks 3 and 4, both located in Punta del Este basin. The contracts between ANCAP and the consortium have already been signed and the exploratory work is starting. The first exploratory program has a duration of 4 years.

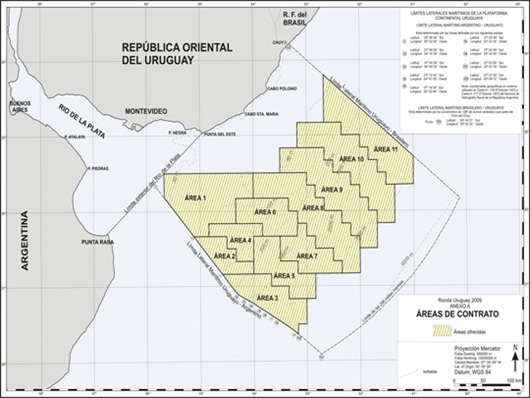

Map of offered areas. Offers for blocks 3 and 4 were received. Both blocks are located in Punta del Este basin

Therefore, the objectives set for the project Uruguay Round 2009 were achieved and it was considered a success, not only at internal level inside ANCAP but also at Governmental and international level, as it is expressed by foreign exploration and production of hydrocarbon specialized consultants and media.

The Uruguay Round 2009 combined the political, economic and social stability of our country, which provides an optimal business and investment environment, with an intriguing and under explored geology – with many analogies and correlations with geologic and exploratory features of productive basins of the Atlantic margin – and finally with sound, fair and according to the exploratory risk bidding round terms and contract model.

But Uruguay Round 2009 was only the first step of the process of reactivation of the exploratory activity in our country. It is of vital importance to keep a constant level of promotion, likewise to present to the upstream industry exploration opportunities regularly. For that purpose, a key aspect is that ANCAP keeps rising the value of the mining assets of our continental shelf through increasing the knowledge on its exploratory potential. That will be achieved mainly by the signature of multiclient contracts with service companies that have no or minimal cost for ANCAP. In that sense, ANCAP presented to the upstream industry another bidding round of very similar features, launched in 2011, Uruguay Round II.