9/7/2025

EXPLORATION AND PRODUCTION CONTRACTS

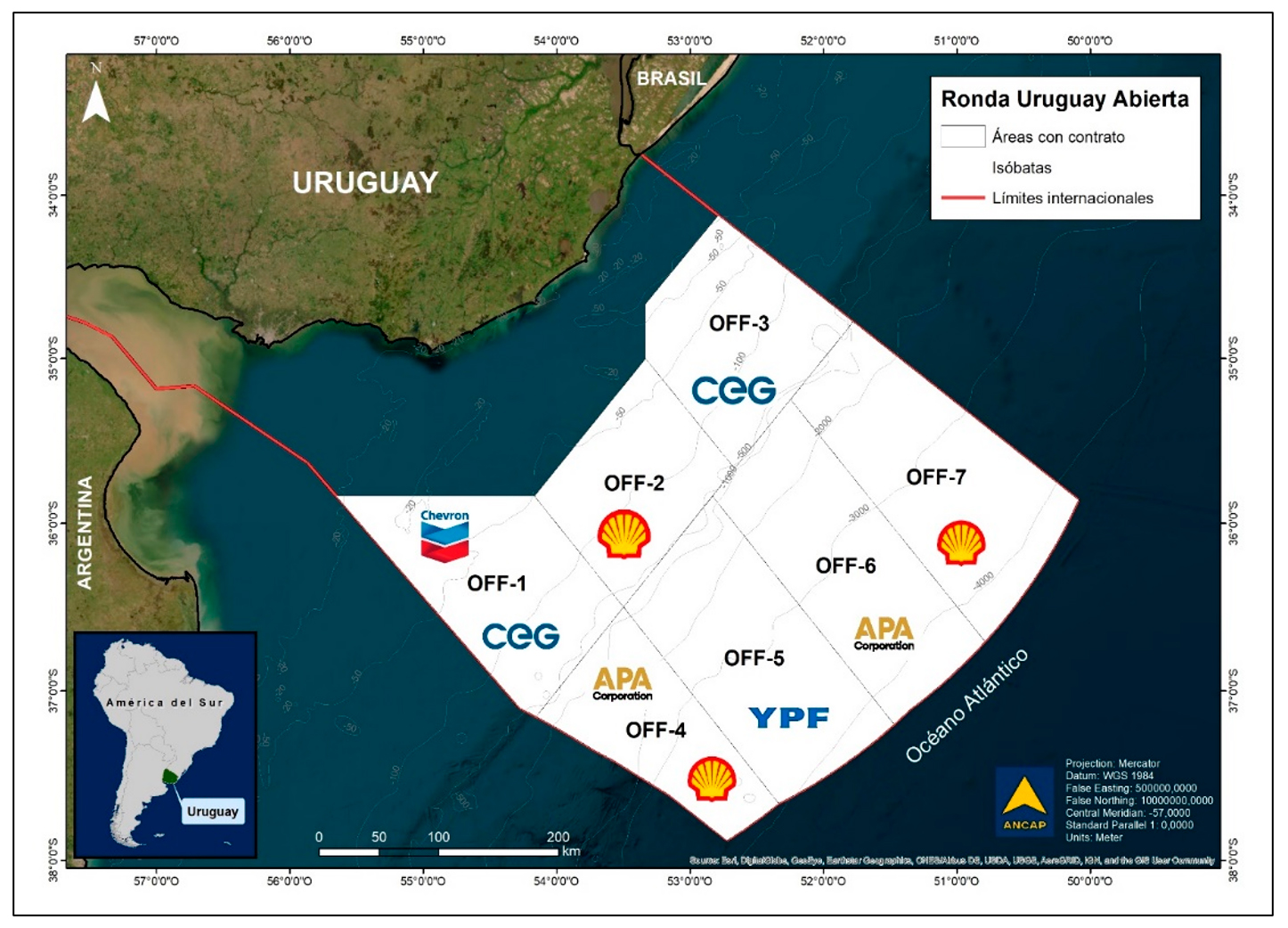

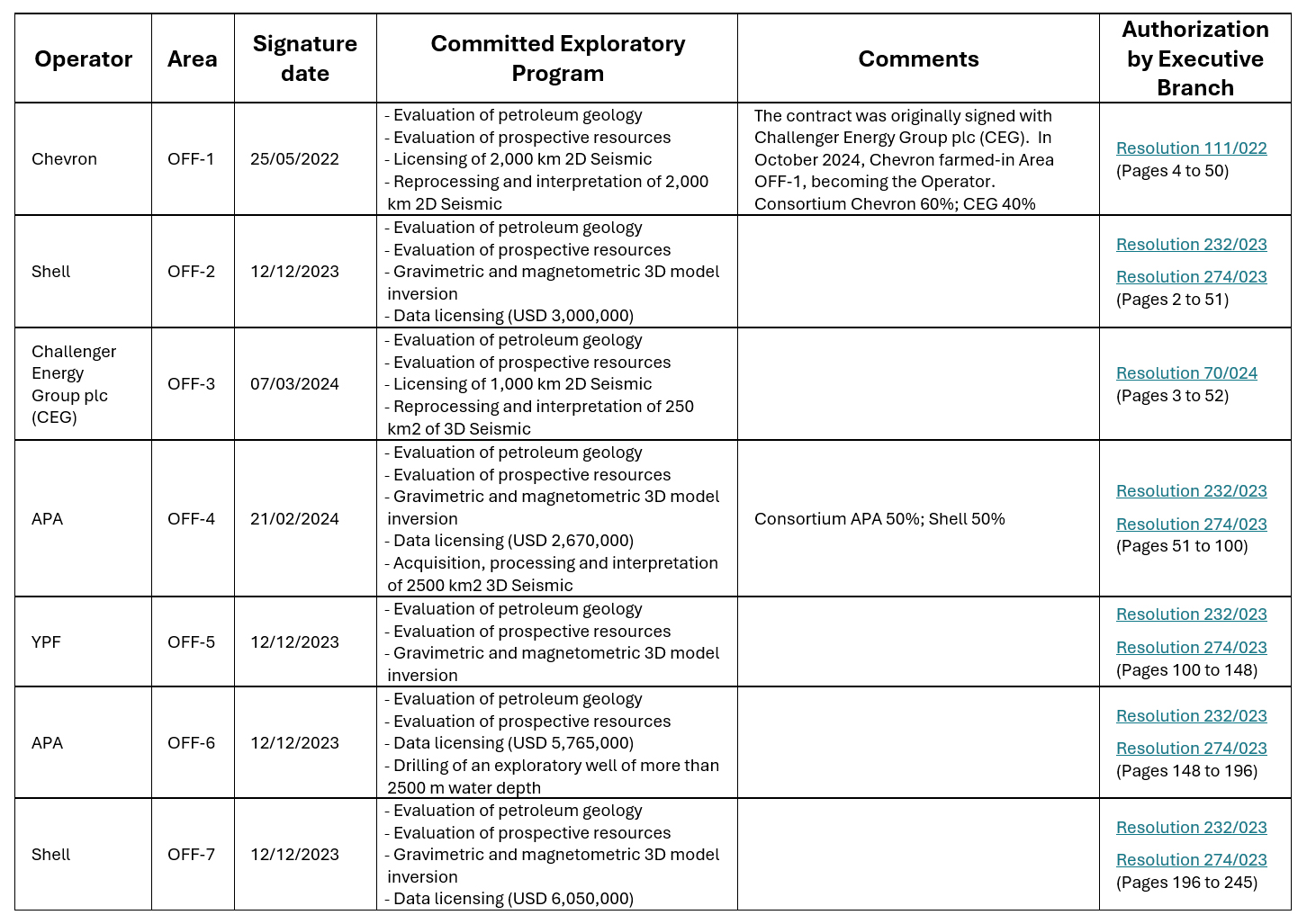

As a result of the Uruguay Open Round process, ANCAP signed exploration and production contracts for the seven areas defined on its continental shelf. The terms and contract models of the Uruguay Open Round (approved by Decree 111/019) were virtually identical, with promotion, awarding, and negotiation processes very similar to those of the Uruguay Round 2009, Uruguay Round II (in 2012), and Uruguay Round 3 (in 2018), all of which were carried out by ANCAP with the endorsement of the Executive Branch.

A hydrocarbon exploration and production contract authorizes the Contractor to exclusively carry out all activities related to Petroleum Operations within the area covered by the contract. The contract is a “Production Sharing Agreement,” which transfers all costs and risks to the Contractor, who is compensated with a share of the production, if any.

Discoveries in Namibia and other parts of the Atlantic margin (e.g., Suriname) have renewed interest in our basins and reduced exploration risk. However, as these are frontier exploration basins, the probability of discovering a hydrocarbon reservoir remains low.

As part of the seven signed contracts, and during the first four-year exploratory subperiod, two key milestones stand out: the drilling of an exploratory well in Area OFF-6 and the acquisition of 2,500 km² of 3D seismic data in Area OFF-4. Additionally, with Chevron's entry as operator of Area OFF-1, further exploratory work has been proposed, including approximately 3,500 km² of 3D seismic surveys—significantly exceeding the original contractual commitments. The total estimated investment for these activities exceeds 160 million US dollars.

Uruguay’s offshore sedimentary basins present significant potential, supported by an extensive geological and geophysical data base. This availability of existing information enables exploration efforts to focus on data analysis rather than new field acquisition campaigns. Operating companies are making satisfactory progress in studying the regional geological context of their respective areas, identifying leads and prospects, and beginning to plan the corresponding operations.

Under these production sharing contracts, the Contractor assumes full responsibility for all risks, costs, and obligations associated with hydrocarbon exploration and production activities. The Contractor is solely responsible for providing the necessary technology, personnel, capital, equipment, machinery, and other investments required for both the exploration of the contract area and the subsequent development and production of any commercially viable deposits that may be discovered. ANCAP retains ownership of all data and information generated under these contracts.

The Contractor recovers its investments and operating costs through Cost Oil only if there is commercial production of hydrocarbons. The profit, referred to as Profit Oil, is shared between the Contractor and the Uruguayan State according to the percentages established in the Contract, which are derived from the bid. ANCAP has the right to join and participate in the project if a discovery is declared commercially viable.

ANCAP promotes the adoption of industry best practices and technologies with the aim of developing sustainable activities. In this regard, the contracts signed between ANCAP and oil companies prohibit the venting and flaring of natural gas. As a result, the carbon intensity of barrels that may eventually be produced in Uruguay—should a commercial discovery occur—is expected to be among the lowest in the world.

MULTICLIENT CONTRACTS

In June 2024, ANCAP and the service companies Searcher, PGS, VIRIDIEN (CGG), and TGS (Spectrum) signed four multiclient agreements to carry out non-exclusive acquisition of 3D seismic data offshore Uruguay, fully at the cost and risk of the aforementioned companies. Multiclient agreements are those in which service providers (particularly seismic and geophysical data vendors) invest at their own expense and risk in acquiring data and/or generating information that may later be licensed by multiple oil companies.

It is important to highlight that these types of agreements are non-exclusive, and all risks and costs incurred during the acquisition of data and/or generation of information are borne by the service company. On the other hand, ANCAP owns the data and information obtained, and also receives a percentage—agreed upon in the contract—of the profits from the sale of licenses for said data.

Since the signing of these contracts, the service companies have managed the environmental authorization process for their 3D seismic projects before the Ministry of Environment. Due to the merger between TGS and PGS, the environmental authorization process for TGS (Spectrum) has been withdrawn.

ENVIRONMENTAL AUTHORIZATIONS

Exploration projects, marine seismic surveys, and the drilling of exploration wells require authorization from the Ministry of Environment. This includes an assessment of the project's environmental and social impacts, as well as the incorporation of necessary prevention, mitigation, compensation, and monitoring measures to reduce impacts to acceptable levels. In the event of a commercial discovery and the development of a hydrocarbon reservoir, the project will also be subject to prior environmental authorization, along with other permits and oversight throughout the project's lifecycle until its abandonment (the contracts establish the creation of an abandonment fund).

The exploration projects being developed in Uruguay incorporate environmental management practices and technologies that are among the most stringent globally. For example, marine seismic projects adopt recommendations from the United Kingdom and Brazil to prevent and mitigate impacts on marine mammals; from the Gulf of Mexico and Brazil for the protection of sea turtles; and from Norway for the prevention, mitigation, and compensation of impacts on fish and fisheries. Requirements include the presence of marine fauna observers on board the seismic vessel for visual monitoring, passive acoustic monitoring under low-visibility conditions, gradual ramp-up of seismic pulses to allow fauna to move away, physical protection on terminal buoys to prevent entrapment, temporal planning to avoid interference with fishing seasons, and compensation in the event of any potential impact, among other mandated measures.

To prevent cumulative impacts on biodiversity and fishing activity and based on the life cycle of the main fishery resources in the area, no more than one seismic survey (3D seismic) will be authorized over the same area within a five-year period.

ENERGY TRANSITION

Our country has made progress in the energy transition, generating its electricity almost entirely from renewable sources, and has identified biofuels and green hydrogen and its derivatives as key sustainable fuels to further deepen the transition. The goal is to decarbonize other sectors of the economy that are difficult to electrify, such as heavy transport and industry.

Investment in oil and natural gas exploration remains a global necessity, as new discoveries must offset the natural decline of producing fields—even under the most accelerated transition and hydrocarbon consumption reduction scenarios.

Uruguay currently consumes more than 45,000 barrels per day of crude oil or derivatives, a level expected to remain steady through 2050. This has a significant impact on the economy due to oil imports. Domestic production of oil and natural gas would allow for a reduction in import dependence, an improvement in the trade balance, and the achievement of energy sovereignty without increasing domestic consumption

Having domestic production of oil and/or natural gas does not necessarily imply an increase in consumption within Uruguay. If the country were not to consume fossil fuels but had production, it could potentially export all of it, benefiting from the revenues generated by these resources to invest in renewable energy, biofuels, and green hydrogen projects—further driving the energy transition. ANCAP continues to explore for oil and natural gas while simultaneously leading the development of sustainable fuels.

Therefore, the exploration and potential production of hydrocarbons does not represent a setback in ANCAP’s ambition to lead the production of sustainable fuels (biofuels and e-fuels), which are beginning to see demand and are expected to be increasingly consumed in the coming decades.